Smart Follow-ups

Automate reminders and alerts to stay connected with leads and customers, ensuring timely responses and improved conversions.

Run your DSA business smarter with real-time insights, automated processes, and seamless lender collaboration. All in a single digital-first CRM.

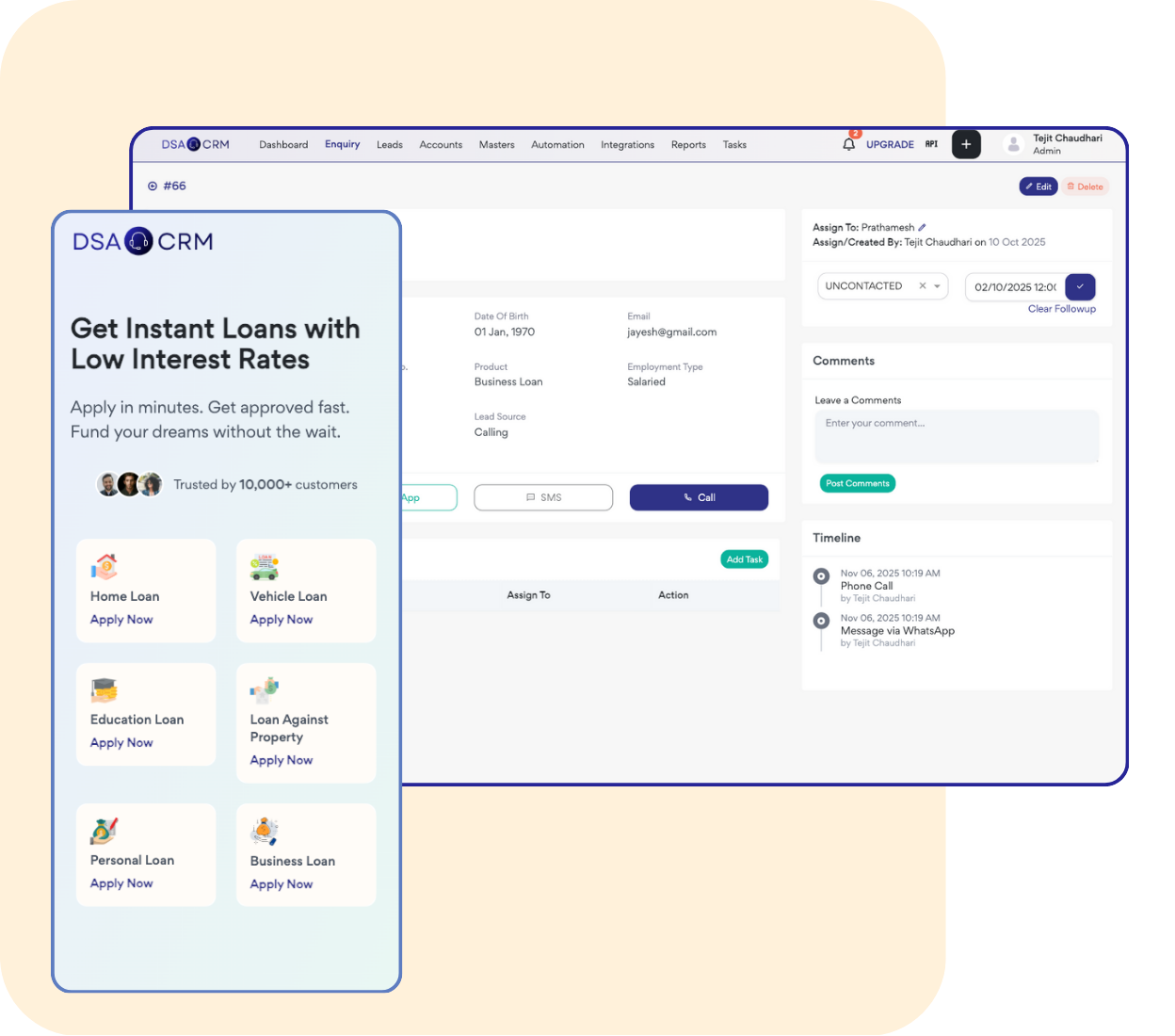

Capture, assign, and monitor leads from all channels (website, WhatsApp, partners) in one dashboard.

Auto-assign leads by branch, loan product, or employee role for faster response and better coverage.

Never miss a call. Auto-reminders and "My Tasks" panel keep every team member on track.

Use UTM-enabled links to trace every lead back to its marketing source.

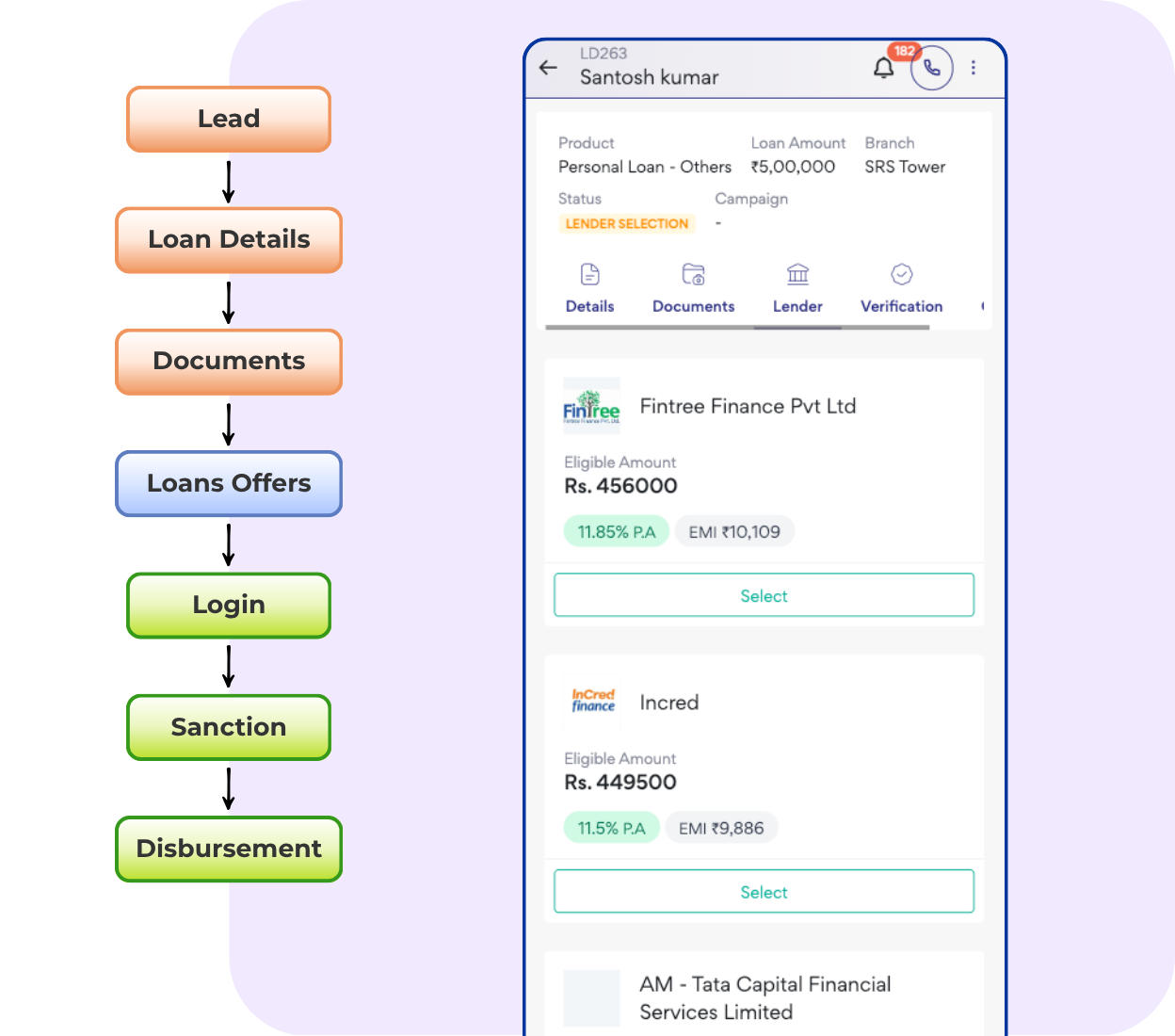

Move from Enquiry to Disbursement with stages like Lender Selection, File Login, Sanction.

Get instant product suggestions based on credit score, FOIR, and lender policy with BRE.

Send secure document links, track uploads, and store files with timestamped history.

Admins, Team Leads, and Agents get custom views of only what they need to act on.

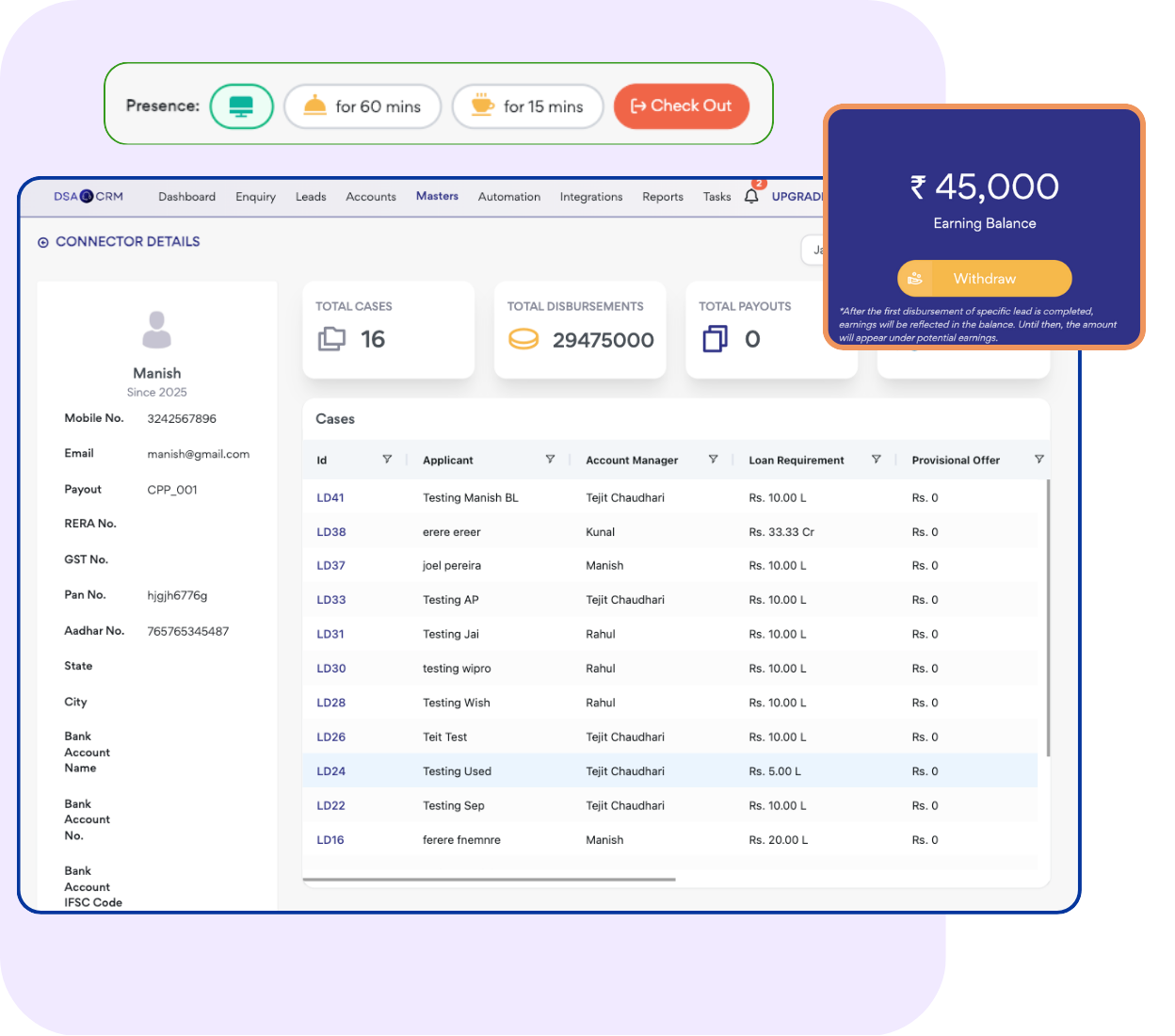

Onboard sub-agents with unique portals. Let them track their leads, earnings, and request payouts.

Define fixed or percentage-based payouts by lender, product, or city. CRM handles the math.

Set up offices, assign teams, define permissions. Track activity by branch or role.

Set sales targets and display live rankings by product, agent or region to boost motivation.

Automate reminders and alerts to stay connected with leads and customers, ensuring timely responses and improved conversions.

Unify calls, chats, and emails in one dashboard, making it easier to track conversations and build stronger customer relationships.

Create UTM-enabled links to measure campaign performance, track lead sources, and understand customer acquisition.

Process applications with multiple lenders in one place—compare offers, speed up approvals, and improve customer choice.

Define business rules and formulas to instantly calculate eligibility, ROI, tenure, and outcomes with zero manual errors.

Manage offerings like home, personal, and business loans with flexibility, ensuring product details are always up to date.

Control access by assigning stage-specific visibility, ensuring every lead is handled securely and efficiently.

Instantly verify customer identity with secure KYC APIs that reduce fraud risks and ensure compliance in real-time.

Collect customer documents securely with a simple upload link, making submissions fast, paperless, and trackable.

Send all required documents directly to bankers with a single click, reducing processing delays and boosting efficiency.

Store, organize, and manage product-specific documents in a centralized master for quick access and compliance.

Build clear organizational hierarchies with defined reporting lines, improving accountability and structured workflows.

Run multiple branches with centralized control while giving branch-level teams the tools to work independently.

Assign roles and set permissions at every level, ensuring only authorized team members can access sensitive data.

Track attendance, leaves, and generate reports instantly to monitor team discipline and overall productivity.

Assign tasks, set priorities, and monitor completion progress in real time with an easy-to-use task board.

Monitor progress, assign goals, and reward achievements with real-time insights that boost efficiency and motivation.

Easily onboard partners and track commissions with automated payout workflows, ensuring fairness and transparency.

Give connectors a digital wallet to view earnings, manage payout requests, and track payment settlements.

Manage payout requests with approval workflows, ensuring smooth settlements and transparent partner payments.

Distribute leads efficiently across DSAs, lenders, and partners, ensuring fair allocation and higher conversions.

Generate and send invoices to lenders or DSAs directly from the system, simplifying billing and record keeping.

Automate repetitive tasks with built-in N8N integration, streamlining processes and saving valuable team hours.

Experience the power of DSACRM with a personalized demo. See how our platform can streamline your lead management, automate loan processing, and boost your commission tracking—all in one place.

Book A Free Demo